30+ paying mortgage twice a month

See if you qualify. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Should You Make Biweekly Mortgage Payments Forbes Advisor

Compare Now Save.

:max_bytes(150000):strip_icc()/ForeclosureRatesintheU.S.-0d61541396e241e7bd6076afd117ddf5.jpg)

. If you make the payment at the beginning of each year youll. Web Bi-Monthly Mortgage. Ad Compare More Than Just Rates.

But if you switch to a. Web With a bimonthly mortgage youd make payments twice a month usually on the 1st and the 15th. Web Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web Lets say you have a 30-year fixed-rate mortgage for 250000 with a 32 percent interest rate. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web Granted if youre planning to stay in your home for 30 years you may not give two shakes about paying extra and feel comfortable anticipating the same. A mortgage plan where half the scheduled monthly payment is made twice a month. They might seem the same but theres a difference.

Web Use our free mortgage calculator to estimate your monthly mortgage payments. Web However another cost of paying off a mortgage early is higher taxes. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Lock Your Rate Today. Web The payment option commonly called bi-monthly is a bi-weekly payment option. Web Biweekly mortgage payments.

Ad Compare the Best Home Loans for March 2023. Web If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you 35000 in interest payments. Mortgage interest is tax deductible.

Lock Your Rate Today. When you enroll in a biweekly payment program youre paying half. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Your monthly payment would come to 1081. A 100000 mortgage with a 6 percent interest rate. This plan is not to be confused with a bi-weekly plan.

Web For example if you have a 30-year loan with 1450 monthly mortgage payments youll pay 17400 per year toward your mortgage. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. Web If you pay your mortgage monthly like most homeowners youre making 12 payments a year.

Get Instantly Matched With Your Ideal Mortgage Lender. Apply Get Pre-Approved Today. Ad 30 Year Mortgage Rates Compared.

Ad Compare the Best Home Loans for March 2023. Some months are longer than others and some are shorter. When you make biweekly payments you.

Web The general rule is that if you double your required payment you will pay your 30-year fixed rate loan off in less than ten years. Apply Get Pre-Approved Today. Find A Lender That Offers Great Service.

However some lenders offer a bi-monthly payment service to homebuyers. Web Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early. Select Apply In Minutes.

Ad See what your estimated monthly payment would be with the VA Loan. The monthly payments were 2044 for 30. Account for interest rates and break down payments in an easy to use amortization schedule.

When you pay half your mortgage payment. 2022s Top Mortgage Lenders. There is an alternative to monthly payments making half your monthly payment every two weeks.

Web Following the above example that would mean paying 800 twice in one chosen month annually. Ad Dedicated to helping retirees maintain their financial well-being. Web Because the calendar year is not divided into 12 equally long months.

Web For example if you have a 100000 30-year mortgage at rate of 65 percent paying a standard monthly mortgage means you will pay 127544 in interest during. Get Instantly Matched With Your Ideal Mortgage Lender. For example Lenas first-year interest expense.

If you have a 200000 mortgage at 3 for 30.

How To Pay Off A 30 Year Home Mortgage In 5 7 Years Youtube

How To Pay Off The Mortgage Early 30 Methods You Can Use Right Now

Biweekly Vs Monthly Mortgage Payments What To Know Chase

Create A Loan Amortization Schedule In Excel With Extra Payments

Does Paying Your Mortgage Twice A Month Save You Money

Pay Off Your 30 Year Home Loan 6 Years Faster 10 Easy Tips Easy

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

Mortgage Guidelines On Late Payments In The Past 12 Months

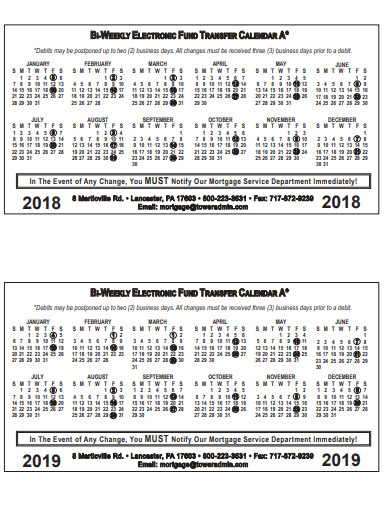

3 Biweekly Mortgage Templates In Pdf

Excel Ppmt Function With Formula Examples

Twice Monthly Vs Mortgage Payment Budgeting Money The Nest

Any Benefit Of Weekly Home Mortgage Payments Wsj

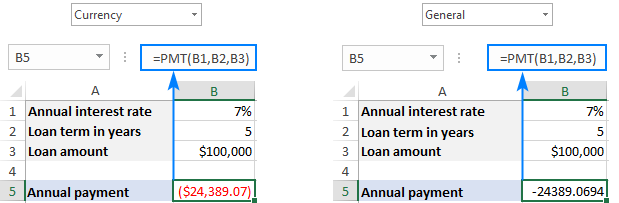

Excel Pmt Function With Formula Examples

How To Create A Biweekly Budget In 5 Simple Steps Clever Girl Finance

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Growing Number Of Mortgage Loans Have Amortization Periods Of More Than 30 Years The Globe And Mail

Loans 30 Days In Arrears By Loan Originator Download Scientific Diagram