34+ what does points mean in mortgage

Discount points lower your mortgage rate by a certain percentage. Web What Are Mortgage Points And How Much Do They Cost.

Loan Delivery Job Aids Overview Of Temporary Buydown

Web Points Points let you make a tradeoff between your upfront costs and your monthly payment.

. Web Mortgage points also known as discount points are a form of prepaid interest. You pay these fees directly to your lender. Borrowers can lock in a lower interest rate on a purchase or refinance loan and pay less on their mortgage over time.

Web What are mortgage points. You will pay this fee up front but secure a lower interest rate for the rest of your payoff period. A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance.

Points can be a good choice for someone who knows they will keep the loan for a long time. Web Points Points are a type of fee thats paid to your lender at closing. For example if you take a loan of 300000 one point would be 3000.

One discount point costs 1 of your home loan amount. For example if you take out a mortgage for 100000 one point will cost you 1000. By paying points you pay more upfront but you receive a lower interest rate and therefore pay less over time.

When you buy discount points youre paying interest up front in exchange for a lower interest rate on. So you might have to pay four points to reduce your rate by a full percent. Paying for discount points is often called buying down the rate and is totally optional for the borrower.

Mortgage points also called discount points are an upfront fee that a borrower pays their mortgage lender to cut down the interest rate on their loan. For example your 500000 mortgage at 45 requires a monthly repayment of 240676. Each point you buy is priced at 1 of the amount youre borrowing.

There are two types. Treasury bonds mutual funds exchange-traded stocks and real estate-based investments. Web Mortgage points are fees you pay a lender to reduce the interest rate on a mortgage.

Buying points can save you money on interest over time but only if you stay in the home long enough for the discounted interest rate to make up for the upfront. Web In real estate a point is an amount equal to 1 of the mortgage. So if the interest rate on your mortgage rises by 100 basis pointsfrom 4 to 5 for exampleyour monthly mortgage payment could rise as well.

Points are calculated in relation to the loan amount. This shrinks your monthly payment because your lender receives a lump sum at closing and collects less money every month. Origination points are mortgage points used to pay the lender for the creation of the loan itself.

Web Mortgage points are a way to save on your monthly payments by putting up more money than required towards interest during closing. For example if your mortgage was at 362 and decreases by 15 basis points it is now at 347. Typically one point is equal to 1 of the loans principal and it usually buys the rate down by 025.

They let you pay more money upfront in exchange for a lower mortgage interest rate. Web Basis points also called bps pronounced bips are units of measurement that assess percentages in finance. Origination Points Origination fee is charged by the lender to cover the costs of processing the loan.

You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. So if you take out a 200000 mortgage a point is equal to 2000. Web A basis point in mortgage is a change equivalent to 001.

This is also called buying down the rate Essentially you pay some interest up front in exchange for a lower interest rate over the life of your loan. Say you buy one point on a mortgage loan of 300000 which costs 3000 1 of the loan amount. Mortgage points offer a trade-off.

There are two types of points. An increase of a single basis point can be worth quite a lot. Origination points and Discount points.

This means youd pay more in closing costs. A single mortgage point equals 1 of your mortgage amount. Another term for this is buying down the rate How do.

Web What Does Buying Points Mean in a Mortgage. Points are a fee that a borrower pays to the lender to get a lower interest rate. Portfolio managers and investors use basis points to indicate the percentage change in interest rates or financial ratios in US.

Depending on the type of mortgage a change in basis points could affect the amount of your monthly payment as well as the total interest youll pay on your loan. Web A mortgage point is an amount equivalent to 1 of the mortgage loan amount. Web Mortgage points are the fees a borrower pays a mortgage lender in order to trim the interest rate on the loan thus lowering the overall amount of interest they pay over the mortgage term.

Web Mortgage discount points allow you to reduce your interest rate by essentially prepaying interest upfront. There are two kinds of mortgage points. Web Mortgage points also known as discount points are fees a homebuyer pays directly to the lender usually a bank in exchange for a reduced interest rate.

Web How Much Do Mortgage Discount Points Cost. Web Mortgage points are fees that you pay your mortgage lender upfront in order to reduce the interest rate on your loan and in turn your monthly payments. One point costs one percent of your overall mortgage amount.

A mortgage point is equal to 1 percent of your total loan amount. A point on a 120000 mortgage is worth 1200 two points are worth 2400 and so on. Web Points are referred to as mortgage points or sometimes discount points.

Discount points can be paid in exchange for a lower interest rate on the mortgage. Lender credits are intended to cover part or all of the borrowers closings costs in exchange a higher interest rate is paid. For example on a 100000 loan one point would be 1000.

Web Why is this math important. Web Mortgage points are used in the loan closing process and are included in closing costs.

A 4 Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast

Eu Council Manual Law Enforcement Information Exchange 7779 15

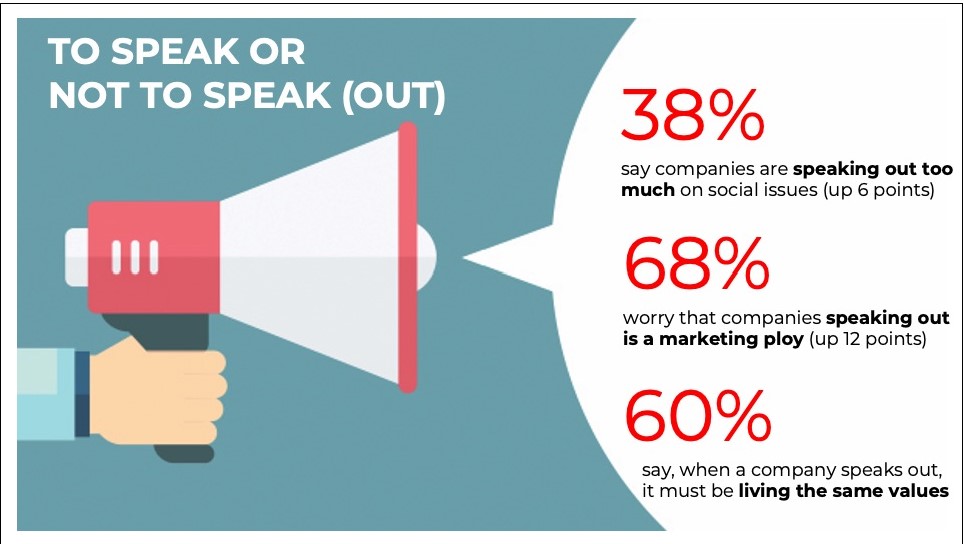

68yiijtcdq50hm

27 Free Application Letter Templates

Sbi Maxgain Home Loan Review With Faq S

Mortgage Preapproval Vs Prequalification How To Get Preapproved

Mortgage Points The Homebuyer S Guide Prevu

Mortgage Points The Homebuyer S Guide Prevu

Mortgage Points What Are They And How Do They Work Bankrate

What Are Points In A Mortgage

What Are Mortgage Points And How Do They Work

Understanding Mortgage Points Credit Com

Hf Markets Review 2023 Should You Sign Up Or Not Test

How To Test Banking Domain Applications A Complete Bfsi Testing Guide

Mortgage Points Calculator Nerdwallet

What Are Mortgage Points And How Do They Work Citi Com

What Are Mortgage Points And How Do They Work Citi Com