How to determine borrowing capacity

Borrowing capacity is a calculation from your lender about how much you can borrow on a home loan. Lenders will determine this factor when youre applying for finance.

The borrowing capacity formula Lenders generally follow a basic formula to calculate your borrowing capacity.

. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. This number will allow them to determine the loan amount you can pay. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a.

Its as simple as entering your individual. When a lender works out how much you can borrow theyll subtract how much you spend from how much you earn. Facebook Twitter LinkedIn Email Print Copy Link More Credit.

Baca Juga

When you apply for a mortgage the lender will use a standard equation to determine your borrowing capacity. Thinking of buying a new property and need to know your mortgage borrowing capacity. Read on to find out how to determine it.

If you are in the market for a new purchase mortgage or are refinancing your existing mortgage loan a mortgage calculator is a useful tool for determining your borrowing ability. By analyzing key metrics from the balance sheet and cash flow. There is a formula based on your income and expenses.

It shows banks that youre a savvy person. So cutting back on monthly expenses is one of. Usually this can be calculated as follows.

Calculate how much you can borrow. Using a borrowing calculator can easily provide you a clear indication of how much you can borrow with a few clicks of a button. Gross income - tax - living expenses - existing commitments - new.

The lender uses factors like your age your income your expenses. Theres also two calcuations that most. The deposit can be of as much as 20 of.

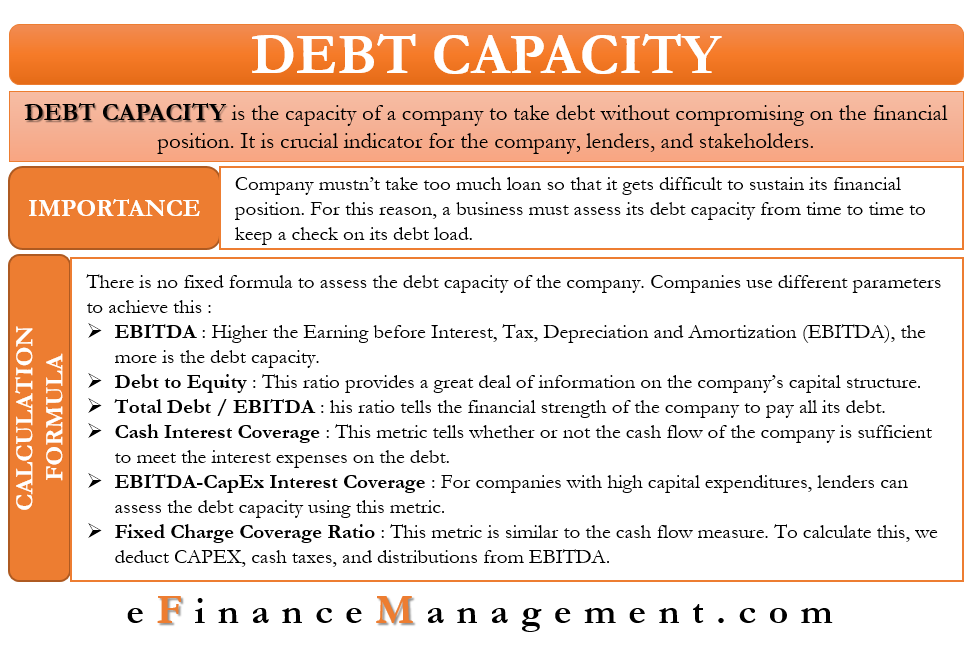

Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs. A solid debt capacity template will use formulas like the current ratio debt service coverage ratio debt to equity ratio and debt to total asset ratio. Your borrowing capacity is the maximum amount lenders will loan to you.

The answer is straightforward. Even if this is not the only element taken into consideration it is of capital importance. Debt level calculation and disposable income calculation.

Using a borrowing calculator can easily provide you a clear indication of how much you can borrow with a few clicks of a. While there is a standard formula lenders follow lenders may assess your income or expenses. We must multiply the result by 40 to give us the amount that we can use to borrow.

Read on to find out how to determine it. How to determine your borrowing capacity By Antony Field March 04 2022 0307. But how do banks calculate borrowing capacity.

Also referred to as borrowing power borrowing capacity is the estimated value you can borrow when buying a house. Two main approaches are typically used sometimes combined to evaluate this borrowing capacity ie. Antony Field Learn about the market before you purchase your dream home Australias booming.

This is most probably because a large deposit is somewhat equivalent with a good financial behaviour. Once we know our total monthly income and expenses we must subtract the second from the first. The two main measures to assess a companys debt capacity are its balance sheet and cash flow measures.

It will take into account. Australias booming residential real estate market is a major worry for those. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider.

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Borrowing Capacity Explained Your Mortgage

Lvr Borrowing Capacity Calculator Interest Co Nz

Debt Capacity Lender Model Analysis Considerations

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt Capacity Model Template Download Free Excel Template

The 5 C S Of Credit What Lenders Look For

How Much Can I Borrow Home Loan Calculator

Debt Capacity Meaning How To Assess And More

Debt To Income Dti Ratio What S Good And How To Calculate It

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Excel Formula Calculate Original Loan Amount Exceljet

Home Loan Calculators Direct Creditdirect Credit

Measuring Repayment Capacity And Farm Growth Potential Farmdoc Daily

What Can Affect Your Borrowing Power

Tips To Increase Your Borrowing Capacity Your Mortgage